Semiconductors in Vietnam: How to Set Up a Manufacturing Subsidiary

April 1, 2024

Introduction

Vietnam is emerging as a key player in Southeast Asia’s semiconductor scene. This article examines Vietnam’s regulatory developments and framework that strengthen and provide incentives for the growth of the semiconductor sector, including tax breaks, industry support, global partnerships, and an overview of business establishment, M&A and licensing processes.

Global Partnerships and Opportunities for Investors

Vietnam has been an attractive destination for high-tech companies seeking to expand their operations due to the country’s strategic location, availability of workforces, and government incentives.

Over the last few years, there were numerous reports of high-ranked foreign politicians and senior business executives visiting Vietnam and expressing interest and support in the sector.

In 2023, during the visit of the US President and the US Semiconductor Industry Association delegation to Vietnam, Vietnam’s potential in this sector was recognized, with certain development support offered.

There has also been notable activity from Dutch business delegations exploring opportunities within Vietnam’s burgeoning semiconductor sector. These delegations have engaged in detailed discussions with Vietnamese counterparts, aiming to foster partnerships and investment opportunities.

One significant outcome of these discussions is the official investment approval obtained for a semiconductor factory situated in southern Vietnam. This initial commitment underscores the confidence and interest the Netherlands holds in Vietnam’s technological landscape.

Measures of Government Support and Incentives

Recognizing the semiconductor industry as a crucial driver of economic growth, Vietnam is channeling resources into all aspects of the semiconductor value chain, from design and manufacturing to packaging.

Several key initiatives have been set in motion to propel Vietnam’s semiconductor industry forward.

The Government’s Resolution No. 124/NQ-CP dated 3 September 2020, among others, mandates the development of a comprehensive plan for human resource development in the semiconductor sector until 2030, with a forward-looking vision towards 2045. This initiative aims to ensure that Vietnam can meet the skilled labor demands of semiconductor companies investing in the country.

Moreover, the establishment of the National Innovation Center (NIC) serves as a cornerstone in Vietnam’s efforts to foster an innovation-driven ecosystem, with a specific focus on high-tech industries like semiconductors. Located at the Hoa Lac High-tech Park 30km to the west of the center of Hanoi, NIC is poised to facilitate collaboration and investment from semiconductor companies, leveraging a streamlined one-stop mechanism to connect businesses with relevant agencies and partners in Vietnam.

While the legal framework for the semiconductor industry continues to be developed, semiconductor projects, given their high-tech nature, can also benefit from existing frameworks.

Decree 111/2015/ND-CP designates semiconductors as a prioritized industrial product eligible for incentive policies, including:

- Preferential Corporate Income Tax Rates: businesses operating in the semiconductor industry, as manufacturers of supporting products, may qualify for preferential tax rates of 10% for a duration of 15 years. Note that the standard corporate income tax rate is 20%.

- Preferential Lending Interest Rate: Enterprises in the semiconductor industry may be entitled to a preferential interest rate on short-term Vietnamese dong loans, as determined periodically by the Governor of the State Bank of Vietnam. Currently, this rate stands at 4% for bank loans.

- Value-Added Tax (VAT) Declaration Period: Generally for corporate taxpayer, VAT on revenue from supporting products listed in the catalog shall be declared on quarterly basis regardless of the revenue size.

- Financial Assistance for environmental protection system: businesses in the semiconductor industry may access loans at concessional rates from the Vietnam Environmental Protection Fund to address pollution treatment and environmental protection aspects of their projects.

In addition to the incentives mentioned earlier, Decree 111/2015/ND-CP also offers non-financial assistance for the advancement of the supporting industry. This includes financial and non-financial support for Research and Development, technology transfer, and Human Resource Development.

Large scale, high impact semiconductor projects could be also eligible for incentives under Decision No. 29/2021/QD-TTg relating to special investment incentives to support high-tech projects, facilitate technology transfers, and encourage collaborations with domestic enterprises throughout the value chain. The incentives include:

- Preferential Corporate Income Tax Rates: preferential tax rates of 9%, 7%, and 5% over periods spanning 30 to 37 years for certain qualifying projects.

- Corporate Income Tax Exemption and Reduction: qualified projects may be entitled to tax exemptions lasting 5 to 6 years, followed by a 50% tax reduction for subsequent periods ranging from 10 to 13 years, contingent upon project classification.

- Land lease Incentives: investors may enjoy exemptions from land lease for periods ranging from 18 to 22 years, coupled with rent reductions ranging from 55% to 75% for the remaining duration.

Additionally, depending on the timing and location of the investment, different provinces may offer supplementary incentives to attract investors in this sector. For instance, within the framework of Decree No. 11/2024/ND-CP, science and technology organizations based in Ho Chi Minh City can enjoy an exemption from corporate income tax, provided these organizations meets the specific criteria delineated for priority sectors by the People’s Council of Ho Chi Minh City.

Making the Investment

Investors have several options for investing in the semiconductor industry, depending on their preferences. The two most common approaches are either establishing a new investment project, or acquiring shares in an existing company.

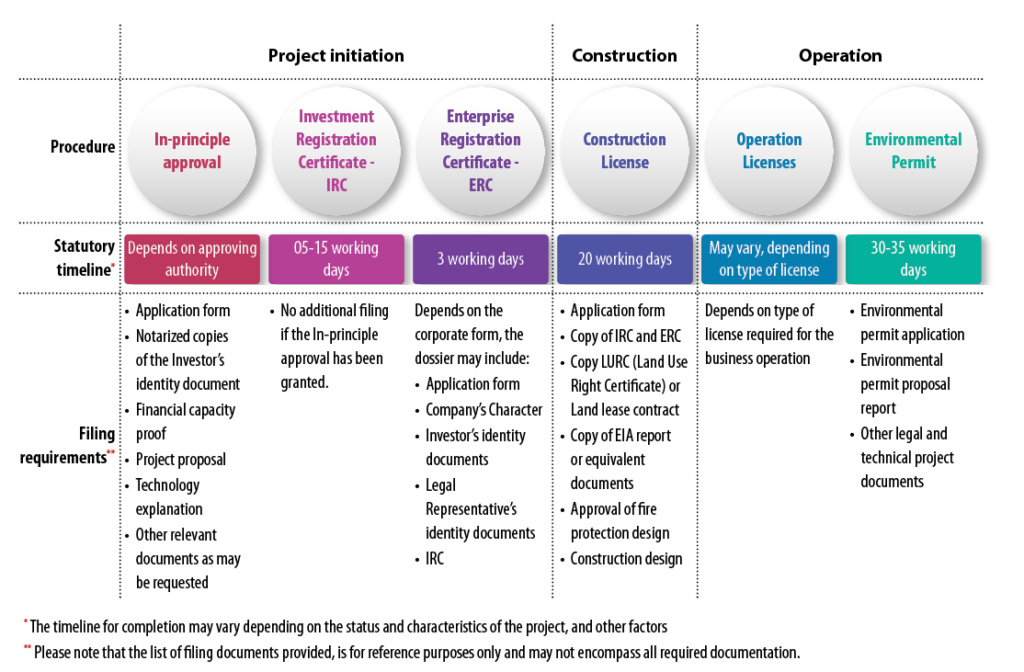

Generally, setting up a new investment project involves three major phases or steps: project initiation, construction, and operation.

Project initiation

Investors keen on developing a project from its inception have several avenues to initiate investment. The interested investor in the semiconductor industry has the option to (1) independently propose a project or (2) participate in a bidding process to secure the opportunity to develop projects proposed by Vietnamese governmental agencies.

In both cases, setting up a new subsidiary to manage the project will likely be necessary.

The primary difference between these investment approaches lies in their initiation process, specifically in the method of proposing projects.

When an investor chooses to independently propose a project, the investor shall undertake the responsibility of compiling and presenting the necessary documentation to secure project approval. This entails substantiating the project’s feasibility and necessity, as well as demonstrating the investor’s capability to effectively execute the proposed project. All aforementioned information is comprised in the investment proposal, which is submitted to a competent authority for assessment. The satisfaction of the assessment is evidenced by an in-principle approval (for large-scale projects) or an Investment Registration Certificate (IRC) for projects not requiring in-principle approval.

It is worth mentioning that an IRC is only required when the investor intends to establish companies where over 50% of their charter capital is held by foreign shareholders or majority foreign-invested companies.

On the other hand, if the investor opts to participate in a bidding procedure, their primary obligation is to furnish evidence of their capacity to meet all the criteria outlined in the proposal issued by the state agency. Unlike the independent proposal route, in this case, incentives and land locations have already been predetermined by the agency.

For example, the Ho Chi Minh City High-Tech Park Management Board is actively seeking investment for a High-Tech Supporting Industrial Production project which is positioned at Lot HT-4-4, situated on Street D17 within the confines of the High-Tech Park in Tang Nhon Phu B Ward, Thu Duc City.

Thus, the investor’s focus shifts to meeting the specified requirements set forth by the governmental body. In this case, the proposed agency will be responsible for obtaining in-principle approval of the investment. The investor, if selected, will typically be issued an Investor Approval Decision.

Setting up a new subsidiary

Establishing a new foreign-invested company in Vietnam would depend much on the outcome of the project initiation process.

After the IRC is issued, the Investor will then apply for and obtain an Enterprise Registration Certificate (ERC) which evidences the company’s incorporation. To ensure a smooth procedure, there are specific considerations that require for extra attention from the Investor. These include:

- Investment and Charter Capital: Total Investment Capital covers all funds allocated for project implementation which will be recorded in the IRC. Charter Capital represents committed capital by shareholders and will be presented in the ERC.

It is notable that under the land law, projects not funded by the state budget yet using land must satisfy certain conditions as to the charter capital. In particular:- Projects using less than 20 hectares of land must have owner’s equity equivalent to at least 20% of the total investment.

- Projects utilizing 20 hectares of land or more must have owner’s equity amounting to at least 15% of the total investment.

- Corporate Structure: The Vietnam subsidiary can be incorporated in one of the several forms available under Vietnamese law.

The most common corporate forms are Limited Liability Company and Joint Stock Company. Limited Liability Companies (LLCs) offer simplicity and flexibility.

JSCs can issue shares and potentially go public in the future. - Legal Representative: Compliance with legal requirements regarding representation is mandatory. Every company must appoint at least one legal representative residing in Vietnam, ensuring prompt and effective handling of legal matters.

This individual serves as the main representative of the company in legal proceedings and is entrusted with executing its rights and obligations. - Business line: In Vietnam, companies have the flexibility to engage in multiple businesses. However, each business line that a company undertakes must be registered with authorities when making application for IRC and ERC.

Land use right acquisition

Under Vietnamese law, land is collectively owned by the people of Vietnam. No individual, whether Vietnamese or foreign, can own land with indefeasible title. Individuals or entities (referred to as land users) can only obtain land use rights through following means:

- Allocation from the State, either for a definite or indefinite period.

- Leasing from the State.

- Sub-leasing through a developer of industrial zones or high-tech zones.

- Recieved from an existing land user through transfer or captal contribution

Land use rights are evidenced by the Land Use Right Certificate (LURC), which can be obtained after the completion of the company setup process.

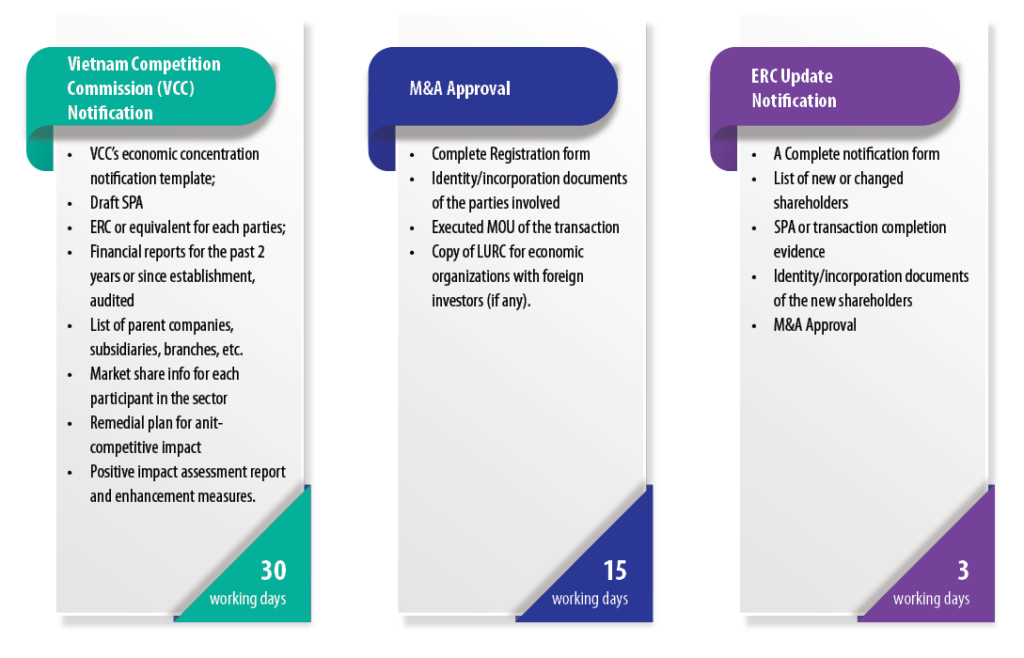

Acquiring shares in an existing company

Foreign investors can also consider the purchase of shares from existing business entities as a way of making an investment. This requires approval from the Department of Planning and Investment (M&A Approval) and amendments to the ERC of the target company to reflect the acquisition.

It is important to bear in mind that M&A transactions in Vietnam are also subject to oversight under the Competition Law. The Competition Law requires Investor engaged in M&A activities to notify the Vietnam Competition Commission (VCC) if certain antimonopoly thresholds are met. These thresholds include:

- Total Assets: Investor/Target Company or their affiliated group has total assets in the Vietnamese market of VND 3,000 billion (approx. USD 126 million) or more in the previous financial year.

- Total Revenue: Investor/Target Company or their affiliated group has total revenue from sales or purchases in the Vietnamese market of more than VND 3,000 billion (approx. USD 126 million) in the previous financial year.

- Transaction Value: the value of the transactions is VND 1,000 billion or more (approx. USD 42 million).

- Combined Market Share: the combined market share of the Investor and of the Target Company is more than 20% in the relevant market in the previous financial year.

The purpose of this notification requirement is to allow the VCC to conduct a review of the proposed M&A transaction and assess its potential implications for market competition. By evaluating factors such as market concentration, competitive advantages, and potential barriers to entry for other market players, the VCC can determine whether the M&A transaction is likely to harm competition or consumers’ interests.

If the M&A activities are deemed to have no anti-competitive effects, the Investor can anticipate receiving a confirmation letter from the VCC allowing the transaction to proceed. The Investor may also generally proceed if no objection is given by the VCC within 30 days from the submission date of a valid dossier.

Other permits

During both the construction and operational phases, various permits may be required, depending on the specific activities undertaken by the investor. Permits that can be expected for a manufacturing business may include construction permits, environmental permits, and business operation permits.

In Vietnam, construction activities are governed by strict regulations outlined in the Law on Construction. Generally, except for limited exemption cases, any construction works would require construction permits from competent state agencies. These permits are granted to project owners following a comprehensive assessment, which examine factors such as environmental impact and firefighting measures.

Environment permits are necessary for the operational phase but not mandatory for all projects.

According to the law on environmental protection, investment projects are categorised into five groups based on criteria like scale, production type, land use, natural resource use, and environmental sensitivity factors. Each group has specific requirements. Typically, projects in Groups I, II, and III, which generate wastewater, dust, exhaust gases, or hazardous waste needing treatment before being released into the environment, require an environment permit for operation.

Due to regulatory, security, or environmental reasons, companies in certain industries in Vietnam are subjected to conditions mandated by relevant authorities. Compliance with these conditions is typically evidenced by a license, certificate, or confirmation document, approval document granted from one or several competent authorities (the “Operating Permits”). The semiconductor industry as such currently does not have a mandatory requirement for a separate operation permit. However, it is noteworthy companies in Vietnam may register various business lines and they may still necessitate a permit for operation of one of the registered business lines. Therefore, investors are advised to thoroughly investigate each registered business line to ascertain regulatory obligations applied to such business line.

Recent Publications

Legal Update

Legal UpdateTax Update

Recent News

Project Finance Workshop at Andersen Vietnam

Read More »

Andersen in Cambodia and Vietnam shortlisted for the 2025 ITR Asia-Pacific Tax Awards

Read More »

Andersen Vietnam Publishes Its Market Entry Guide for Vietnam Prepared in Collaboration With the Investment Promotion Agency of Da Nang

Read More »